Unilever announced its results for the first quarter of 2016

Advertisement

- Underlying sales growth 4.7% with emerging markets up 8.3%

- Underlying volume growth 2.6% and pricing up 2.0%

- Turnover declined 2.0% to €12.5 billion including a negative currency impact of 7.1%

Commenting on the results, CEO Paul Polman says: “The first quarter demonstrates a strong volume-driven performance, following on from a good delivery in 2015. We are maintaining momentum despite a tougher external environment, with all four categories gaining market share. This broad-based growth, including 8% in emerging markets, shows the validity of our strategy, active portfolio management and a step-up in innovation.

“With markets remaining volatile, we continue to focus on driving agility and resilience in our business through the key programmes which we set out at the end of last year: net revenue management, zero based budgeting and the next stage in our continued organisational transformation. This will position us well to deliver another year of volume-driven growth ahead of our markets, steady improvement in core operating margin and strong cash flow. These underpin sustained long-term value creation for our shareholders.”

Our markets

Consumer demand remained fragile. Volume growth slowed further in the markets in which we operate, with market growth weak in emerging markets, negligible in North America and negative in Europe.

Overall performance

Underlying sales growth in the first quarter was driven by market share gains across all four categories. Emerging markets grew by 8.3% with an increased contribution from volume. There was strong underlying price growth in Latin America and virtually no pricing in Asia. Developed markets declined by 0.3% with volume growth offset by widespread price deflation in Europe.

Personal Care

Personal Care grew ahead of the group average driven by innovations that grow the core of our brands and extend into more premium segments. At the same time we are addressing the higher growth male grooming segment with the launch of the new Axe range, opening the brand to a broader audience.

Deodorants continued to perform strongly, supported by new variants of the successful dry sprays in North America and by the roll-out of Rexona Antibacterial that provides 10x more odour protection into 15 countries. In hair, TRESemmé launched the Beauty-Full Volume range with a unique reverse conditioning system that delivers softer and more voluminous looking hair. In skin cleansing, Lifebuoy demonstrated strong volume-driven growth across our emerging markets helped by digital and local activation behind our handwashing campaign.

Foods

Good growth in savoury was led by cooking products in emerging markets and by innovations around naturalness such as Knorr Mealmakers with 100% natural ingredients in Europe. Hellmann’s drove strong growth in dressings driven by a new ‘Real’ campaign, the success of the convenient squeeze packaging with proprietary easy-out technology, and the launch of Carefully Crafted and Organic variants.

The Baking, Cooking & Spreads unit repositioned Flora in the UK with a campaign that highlights its plant-based health credentials and introduces a dairy-free variant. Sales in spreads declined as a result of the continued market contraction in developed countries.

Home Care

Home Care delivered another quarter of strong, broad-based growth, well ahead of our markets. This was driven by innovations in higher margin segments and the new Omo with enhanced formulation and improved cleaning technology which has now reached 18 countries. After the success of Omo pre-treaters and stain removers in Brazil, we are rolling them out in Latin America.

Fabric conditioners grew at double-digit rates, helped by new variants of Comfort Intense with its concentrated, double-encapsulated fragrance technology that deliver long-lasting freshness. Household care remained a strong growth and margin contributor to Home Care, driven by Cif’s premium Power and Shine sprays in Europe and the continued expansion of our brands in emerging markets, the most recent being Sunlight in China.

Refreshment

Ice cream continued its strong momentum of the last two years driven by margin-accretive innovations behind premium brands such as the new Magnum Double range, the Ben & Jerry’s Wich cookie-dough sandwich and premium desserts under Breyer’s Gelato and Carte D’Or Sorbet. We are addressing the value segment with a new yoghurt variant of the smaller-sized Cornetto at a recommended resale price of €1.

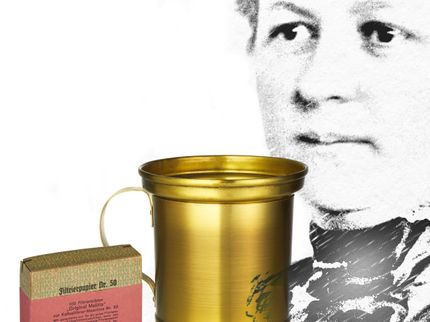

In leaf tea, we are accelerating the move towards more premium products with T2 and machine-compatible tea capsules. Lipton and PG Tips are continuing to extend their presence in the faster-growing green, herbal and speciality teas segments.