Ethical and health credentials can drive interest in the free-from market

Advertisement

Avoiding certain foods/ingredients is common in the UK, with nearly half of consumers reporting avoidance in their household. Rather surprisingly, the avoidance of foods or ingredients due to allergies/intolerances is not the primary reason driving consumers to avoid certain foods/ingredients, signaling that choice rather than necessity is at the heart of the appeal of free-from foods. The associations that free-from foods have enjoyed with health benefits has underpinned the growth in the market, however ethical and environmental concerns are now playing a major role in boosting the appeal of these products. Dairy is the most commonly avoided ingredient which the media buzz around the negative environmental impacts of the dairy industry has supported.

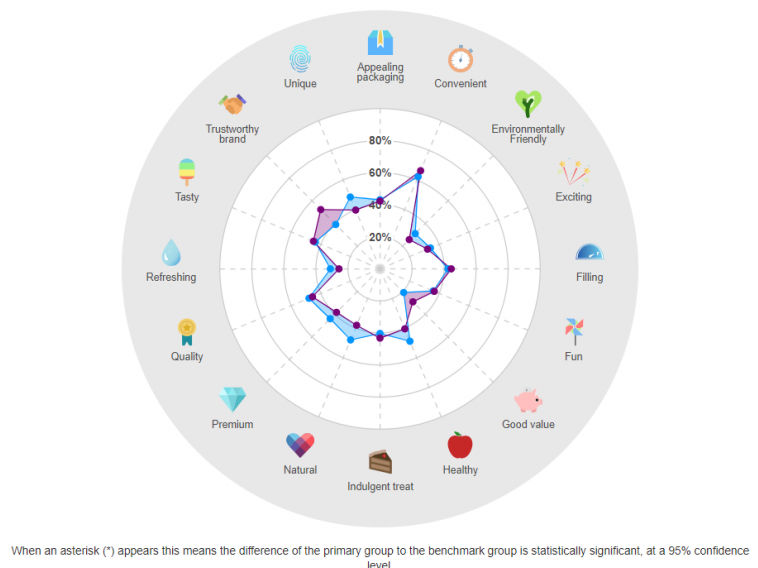

Mintel Purchase Intelligence helps identify new product launches, claims, or features that resonate most with consumers. Blue line – Branded free-from bakery and dairy products Purple line – Own-label free-from bakery and dairy products

Mintel Purchase Intelligence

Warburtons Gluten Free High Protein Wraps

Mintel

Gluten Free Nutri-Brex cereals

Mintel

Reflecting the fact that younger generations are increasingly concerned about animal welfare and environmental damage, 16-24s are the most likely age group to report avoidance, with a significantly larger proportion of this age-group citing ethical reasons for doing so rather than avoiding foods/ingredients as part of a healthy lifestyle.

Environmental concerns driving interest in dairy-free products

Heightened awareness of the detrimental impact that meat and dairy production has on the environment, alongside concerns over animal ethics, has given rise to a new trend called ‘reducetarian’, with adopters significantly reducing their consumption of meat, seafood, eggs and dairy products. The multi-dimensional appeal of dairy-free and dairy alternative products therefore extends far beyond the limited pool of consumers with a dairy allergy/intolerance.

Additional nutrition labelling can give the gluten-free segment a boost

In contrast to the free-from market’s core message that products do not contain certain foods/ingredients, ‘positive nutrition’ credentials are deemed to be the most useful on-pack information for free-from foods. As well as reassuring consumers following free-from diets that they are not at risk of missing out on key nutrients, a focus on this angle is well-placed to win over those choosing free-from products as part of a healthy lifestyle.

High/added protein has been a major innovation trend in the wider food and drink market in recent years thanks to the health halo of protein, however, only 30% of gluten-free launches featured this claim in 2017. The lion’s share of these claims appeared in the snacks market, indicating space for high protein innovation in other markets which could extend the appeal of free-from foods to a wider audience. Warburtons Gluten Free High Protein Wraps, for example, contain 7g of protein per wrap, which helps contribute to growth of muscle mass:

Gluten-free foods that carry a vitamin or mineral fortified claim are extremely niche, with just 1% of launches in 2017 carrying such a claim. A rare example comes from Gluten Free Nutri-Brex cereals, which are rich in vitamins and highlight twice on the front of pack that they are low in sugar, tapping into overall consumer interests in healthy food attributes.

Own-label free-from products are making inroads in the market

Despite small specialist brands historically being the front runners in the free-from market, own-label has been making significant inroads into the market. Many retailers expanded their own-label free-from lines in 2017-18, with discounters Aldi and Lidl also adding their first permanent free-from lines.

The popularity of own-label in the overall food and drink market is largely underpinned by a strong sense of good value for money, with trust also key. Research from the Mintel Purchase Intelligence tool shows that own-label free-from products are outperforming branded products in associations with trust and good value; over half of consumers perceive own-label free-from products to be trustworthy, compared to two fifths for branded free-from products. Brands have the edge over own-label, however, in terms of perceptions of health, uniqueness and naturalness.

Mintel Purchase Intelligence helps identify new product launches, claims, or features that resonate most with consumers. By blending product data from Mintel GNPD (Global New Products Database) with proprietary consumer research, Mintel Purchase Intelligence benchmarks consumer reactions to new food and drink products and also measures the attributes that drive purchase decisions.

What Mintel thinks

Dairy-free companies should respond to concerns over animal welfare and environmental damage by incorporating information on any benefits to the environment or, where applicable, ethical claims on packaging to boost their appeal among ethically-minded consumers. Gluten-free products fortified with macronutrients or featuring naturally nutrient-dense ingredients can reassure consumers that they are not missing out on vital nutrients by swapping to these products while also capitalising on the ongoing positive nutrition trend.

Food Matters Live

Mintel’s Global Drinks Analyst Jonny Forsyth will be discussing how the alcohol sector can capitalise on the ‘free from’ revolution on Tuesday 20th November at Food Matters Live at Gallery Room 7 in ExCel London.

And don’t forgot to visit Mintel at Stand 802 to try out Mintel Purchase Intelligence for yourself and test your expertise on consumers’ purchase intent.