Ritter Sport increasingly popular abroad

Alfred Ritter GmbH & Co. KG sets course for further growth

Advertisement

On the occasion of the International Sweets and Biscuits Fair (ISM), Alfred Ritter GmbH & Co KG reports a continued positive development of its international business. In its home market of Germany, however, the family-owned company had to accept slight losses and closes the 2019 financial year with total sales of around 480 million euros (2018: 489 million euros).

Ritter Sport increasingly popular abroad

Ritter Sport

Overall, Waldenbuch is not dissatisfied with the development. "2019 was a year of transition," explains Andreas Ronken, Chairman of the Management Board. "We have set the course for further growth in the coming years." Over the past few months, Ritter Sport has established a new marketing structure that is designed to help to address markets in a more targeted and specific manner by more closely dovetailing sales and marketing.

The importance of foreign business for Ritter Sport continues to grow. In 2019, international markets will account for around 48 percent of total sales (2018: 42 percent). Ritter Sport is particularly in demand in Russia, where the company will sell over 10,000 tonnes of chocolate for the first time in 2019, representing a 17.5 percent increase in sales. The rest of Europe and the USA also continue to develop positively. The Swabian family-owned company is working the fast-growing Asian markets from Singapore and, in future, also from the Shanghai branch established at the end of last year.

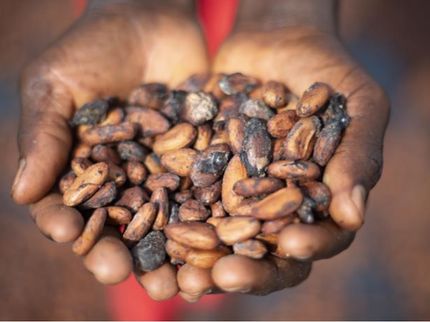

In the highly competitive and action-driven German chocolate bar market, Ritter Sport is losing market share (by value in 2019: 17.2 percent, in 2018: 18.1 percent; by volume in 2019: 16 percent, in 2018: 17.8 percent, IRi). The company also attributes this to shifts in emphasis in its own marketing. Instead of focusing on as many direct sales promotion campaigns as possible in the food retail trade, Ritter Sport increasingly focused on investments in the brand. The cocoa class, for example, which was introduced at the beginning of 2019 and comprises three single origin varieties, has benefited from this, and a fourth variety will be added this year. The cocoa class is the expression of a new brand strategy that places greater emphasis on cocoa. "We want to create an awareness of the value and variety of flavours of cocoa as a natural raw material," explains Managing Director Andreas Ronken. "One year after the market launch, we can say that we have succeeded. The cocoa class has exceeded our expectations."

Ritter Sport continues to work intensively on the topics of transparency and traceability in the supply chain and will in future invest an additional 15 million euros per year in the purchase of sustainable raw materials. Since the beginning of 2018, the family business has been the first and so far only large chocolate bar manufacturer to purchase 100 percent certified sustainable cocoa for its entire product range. At the end of last year, it became clear that Ritter Sport is already further ahead than many of its competitors: Öko-Test (issue 12/2019) examined 25 milk chocolates from various manufacturers, particularly with regard to the traceability of cocoa. Only two received the overall rating "good". One of them is Ritter Sport Alpenmilch. As Öko-Test's reporting makes clear, certification is a very important first step, but is not in itself sufficient to ensure full transparency and traceability. Ritter Sport therefore relies on direct contact with farmers and producer organisations in order to improve social, economic and ecological conditions through concrete programmes on site in the growing countries.

Ritter Sport is now also ensuring greater transparency for another raw material and has been using exclusively segregated, certified sustainable palm oil (RSPO) since the beginning of 2020. Ritter Sport is accepting an increase in costs of around 25 percent for the improved traceability associated with this. Even though only about a third of the assortment contains palm fat, it is indispensable for filled chocolates, because palm fat gives a filling the desired consistency and is also neutral in taste.

"With a diverse range of products, communication that puts quality and enjoyment first, and a supply chain that is in harmony with people and nature from the cultivation of the raw materials to the finished product, we are looking positively to the future," emphasises Andreas Ronken. The family-owned company also has its sights set on the future in its Swabian home region, where around 32 million euros are currently being invested in an innovation centre for flexible and agile cooperation and the construction of a new packaging and raw materials warehouse.

Note: This article has been translated using a computer system without human intervention. LUMITOS offers these automatic translations to present a wider range of current news. Since this article has been translated with automatic translation, it is possible that it contains errors in vocabulary, syntax or grammar. The original article in German can be found here.