Support sustainable, cultivated meat or lose £2.1bn economy boost, government warned

Industry could also create 16,500 jobs by the next decade, Oxford Economics finds

Advertisement

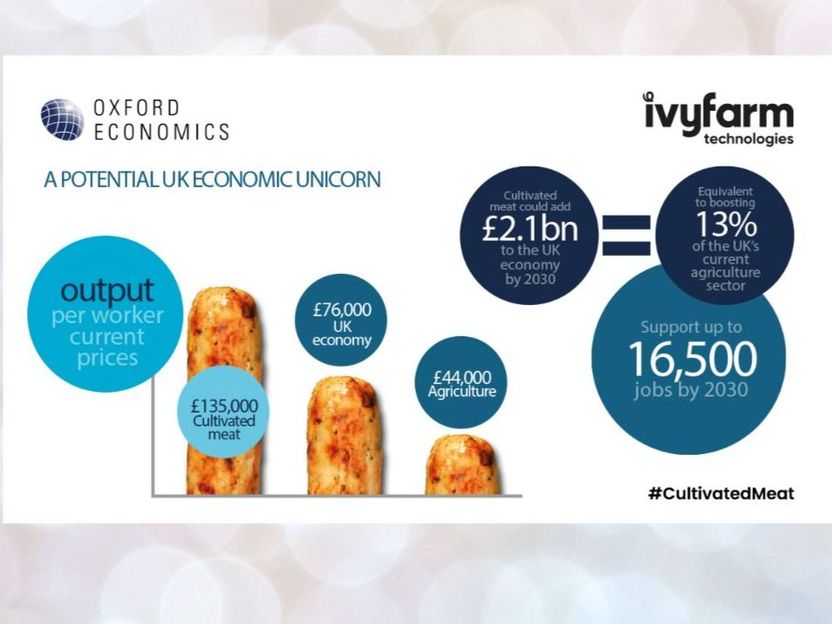

The UK risks missing out on a £2.1bn windfall if it delays giving the green light to Britain’s emerging cultivated meat industry, according to a report issued today.

New figures show lab-grown ‘cultivated’ meat could add £2.1bn to the UK economy by 2030 – 13% of the UK’s agriculture sector

Ivy Farm

The new figures reveal the sector is also primed to provide up to 8,300 new highly-skilled UK jobs – with the same again generated in the broader supply chain – by 2030 as consumers start to embrace sustainable meat produced without killing animals.

According to the study authored by researchers from forecaster Oxford Economics, hitting £2.1bn gross value added (GVA) contribution to UK GDP in 2030 would mean cultivated meat was singlehandedly accounting for 13% of the cash pumped into the UK’s economy by the agriculture sector.

The industry would also boost tax coffers by £523m – but only if UK regulator the Foods Standards Agency (FSA) rubber stamps its approval for sale in the UK by the end of next year and allows the UK to catch up with other countries that are already supporting the sector.

UK cultivated meat pioneer Ivy Farm Technologies commissioned the study as part of its drive to help ministers understand the potential of products made with real meat – but with a fraction of the carbon footprint of traditionally farmed livestock.

Currently, nearly half the worldwide harvest is required to feed the livestock population and scientists have called consumption of meat the “6th mass extinction event” due land clearance and its direct and indirect contribution to increasing greenhouse gases.

Oxford Economics researchers looked at the economic contribution to the UK based on solely domestic consumer spending on cultivated meat in the year 2030 and found:

- The industry itself will be worth up to £1.7bn by 2030 in the UK – and will support a total GVA contribution to UK GDP of up to £2.1bn once the UK supply chain is factored in

- The cultivated meat industry will have a ‘GDP multiplier’ of x3.7 in 2030 – for every £1m of GVA created by the industry, a further £2.7m is expected to be supported elsewhere in the UK economy that year

- The British cultivated meat industry could support up to 16,500 jobs across the UK in 2030 – up to 8,300 workers (50%) employed directly by the cultivated meat industry and the rest in the supply chain

- The cultivated meat sector would account for roughly 12% of consumer demand for meat in 2030

- The industry will have an ‘employment multiplier’ of x2 in 2030 – for every 100 jobs in the industry, a further 100 will likely be supported elsewhere in the UK economy

- The UK risks losing out to countries such as US, Singapore and Israel, who are proactively supporting this new industry

Ivy Farm Technologies CEO Rich Dillon said: “This is the first time a definitive economic dataset has been calculated for the UK’s cultivated meat industry and we’re urging the government and the FSA to study the report carefully. If we don’t move quickly, countries like Singapore that have already approved cultivated meat for consumption will leave us in their wake.

‘The environmental benefits of producing real meat without livestock farming are well understood, as are the animal welfare and human health advantages. And we know that consumers are ready to try it and buy it.

“Now we have the missing piece of the jigsaw that fills in the economic benefits to the UK. If we can release the handbrake and seize the ‘first mover’ advantage, the UK can become a powerhouse for alternative proteins, exporting our products and technology across the globe and reducing the UK’s reliance on imported meat.”

Oxford Economics Director of Economic Consulting, Henry Worthington, said: “Our analysis has highlighted the cultivated meats sector’s strong potential for growth within the UK and the substantial economic footprint that the market will support through the value chain.

“Strikingly, from whichever angle you look, the public policy rationale for regulatory approval of cultivated meat appears compelling, from “net zero” to the war against obesity to building a more research-intensive economy, this industry aligns seamlessly with stated government policy objectives.

“The industry may be in its infancy now, but it clearly presents significant opportunities for entrepreneurs, investors, and other commercial partners to exploit the global potential of a move away from conventional farming towards more sustainable methods.”

Other news from the department business & finance

Most read news

More news from our other portals

Something is happening in the food & beverage industry ...

This is what true pioneering spirit looks like: Plenty of innovative start-ups are bringing fresh ideas, lifeblood and entrepreneurial spirit to change tomorrow's world for the better. Immerse yourself in the world of these young companies and take the opportunity to get in touch with the founders.