Diageo sells Guinness Cameroon S.A. to Castel Group for £389m

Reflects Diageo’s efficient and flexible beer operating model

Advertisement

Diageo announces it has agreed to sell Guinness Cameroon S.A., its brewery in Cameroon, to Castel Group for £389m. On completion, Castel will take over the production and nationwide distribution of Guinness in Cameroon under a licence and royalty agreement.

Photo by Elevate on Unsplash

A strategic review of options to support strong growth of Guinness in Cameroon identified capacity constraints. This agreement provides a robust platform for Guinness expansion in both production and distribution via Castel’s five brewing sites and their national distribution network.

Diageo’s flexible, asset-light beer operating model enables it to select the most appropriate structure and route to market, based on local conditions, supporting greater efficiency and profitability.

Commenting on the news Dayalan Nayager, President Diageo Africa, said: “Guinness has outgrown its existing brewery in Douala as a result of its strong performance. Under this new agreement, the brand will have both expanded brewing capacity and distribution. It will remain part of the global Guinness family through direct marketing oversight. We look forward to unlocking even greater potential through this agreement with Castel, ensuring we continue to have great tasting Guinness across Cameroon.”

Guinness marketing in Cameroon will continue to be managed by the Guinness Global Brand Team, who will set strategy with dedicated Diageo resources in market working alongside Castel.

Gil Martignac of Castel noted: "Since its creation, Castel has been constantly on the move. The planned acquisition of Guinness Cameroon marks a new milestone in its development, both in Africa and in Cameroon where it has been recognised as an economic player for many years through SABC. This acquisition expands the company's portfolio in the strategic stout market and strengthens its historical partnership with Diageo in many other markets. Guided by its entrepreneurial spirit, Castel continues its growth momentum and its commitment to promoting the economic and social vitality of Cameroon and the African continent."

The transaction is expected to complete in the first half of fiscal 2023, subject to regulatory clearances. When completed, the transaction will result in an exceptional gain on disposal of approximately £250 million after tax. The transaction’s impact to pre-exceptional eps in the first full year will be immaterial.

Most read news

Other news from the department business & finance

Get the food & beverage industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Protix attracts Rabo Corporate Investments as new investor

Dean Foods Q3 Results Beat Estimates, Provides Outlook Above View

Damm and Ball launch world's first Aluminium Stewardship Initiative certified beverage cans - The Estrella Damm brewery has achieved ASI certification

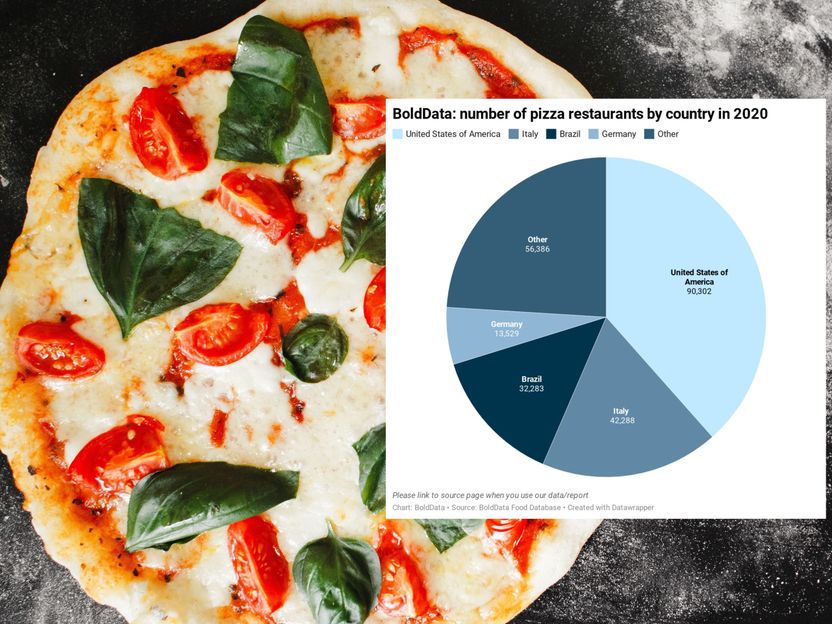

National Pizza Week: growth pizza restaurants comes to abrupt halt - BoldData crunches the numbers

PepsiCo Appoints C.D. Glin As President of The PepsiCo Foundation

Premier Foods FY Profit Rises; Revenue Up 3.6%

Plant-based Chicken Nugget Startup NUGGS Announces Retail Launch and Debut at Expo West

Stevens AI expert to lead major project for NIH-funded Precision Nutrition and Health Hub - Samantha Kleinberg tapped to analyze data from diverse populations to find causal relationships between diets and specific health outcomes

Chickpeas – sustainable and climate-friendly foods of the future - Chickpeas are a drought-resistant legume plant with a high protein content

Suntory Group Global Water Action on the Celebration of World Water Day

Whiskey and cognac businesses deliver record results for Pernod Ricard